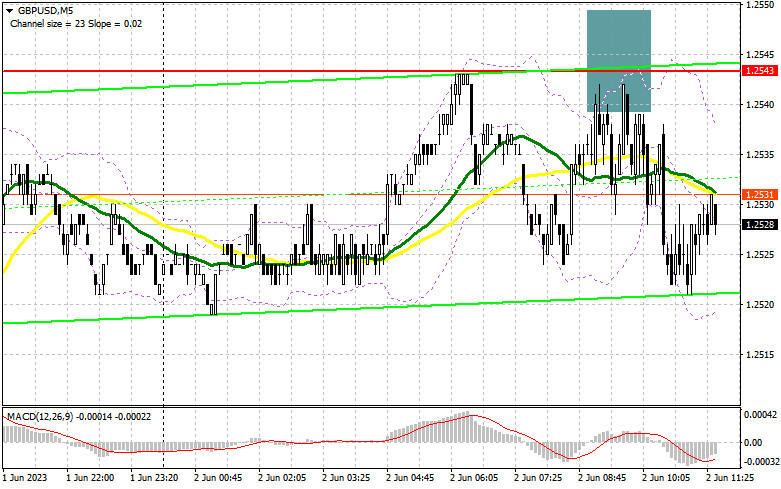

In my morning forecast, I highlighted the level of 1.2543 and recommended making entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. We were just two points away from a false breakout at this level, so I did not decide to enter short positions. Those who entered the market could have seen a downward movement of about 20 points. The technical picture for the second half of the day remained unchanged.

To open long positions on GBP/USD, the following is required:

There is no news from the UK, and there is no significant movement that everyone expects during the American session after the release of labor market statistics. I want to emphasize the weak reports on the unemployment rate growth in the US and the reduction in the number of non-farm payrolls in May this year. These factors will allow pound buyers to increase their long positions, continuing the pair's upward trend. However, it would be more interesting to enter the market after strong statistics, leading to a correction in the pair and a test of the nearest support at 1.2506.

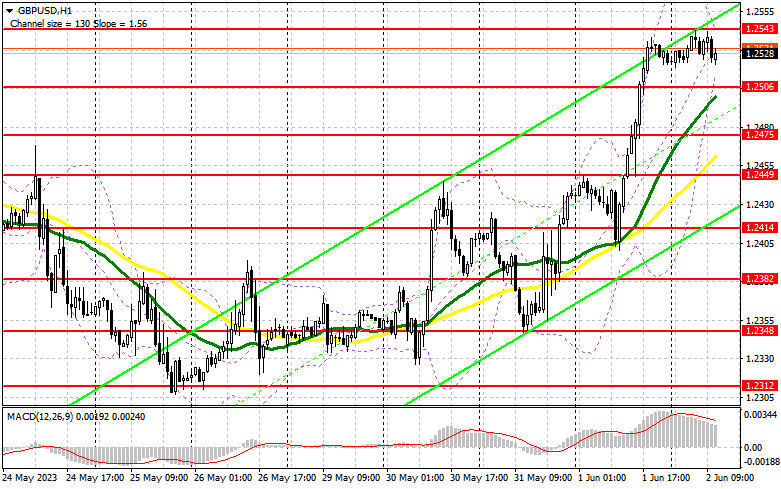

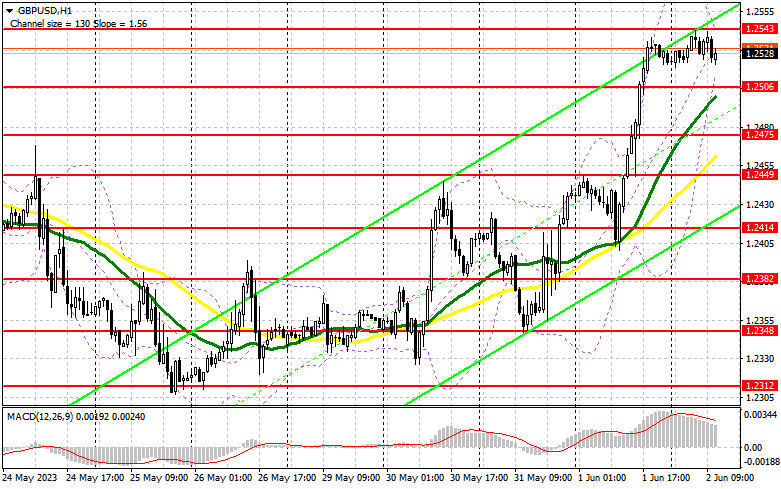

A false breakout formation there will provide a buy signal with the prospect of a new upward surge in the pair towards the resistance at 1.2543, which has already been tested twice today. A breakthrough and a subsequent top-down test of this range will form an additional signal to open long positions and strengthen the presence of bulls in the market with a movement towards 1.2576. The ultimate target will be around 1.2607, where I will take profits. If the pound declines towards 1.2506 and there is no buyer activity, the pressure on the pound will increase. In that case, I will postpone entering the market until the minimum of 1.2475, where the moving averages support the buyers. I will also consider opening long positions there only on a false breakout. I plan to buy GBP/USD on a rebound only from 1.2449, with a target correction of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

Sellers managed to defend 1.2543 but couldn't achieve a significant downward movement from there. In the second half of the day, bears will need strength, especially in the case of weak labor market statistics from the US. I will consider short positions only after a false breakout formation around the resistance at 1.2543. Only then will there be a chance for a downward movement toward the support at 1.2506, a level we didn't quite reach in the first half of the day. A breakthrough and a subsequent bottom-up test of this range will strengthen the bearish nature of the market, forming a signal to open short positions with a decline towards 1.2475. The ultimate target remains the minimum at 1.2449, where I will take profits.

If GBP/USD rises and there is no activity at 1.2543 in the second half of the day, sellers' stop orders will come into play again, leading to a larger upward correction in the pair. In that case, I will postpone selling until the resistance at 1.2576 is tested. A false breakout there will be the entry point for short positions. I plan to sell GBP/USD on a rebound only from 1.2607 but with the expectation of a pair correction of 30-35 points within the day.

In the COT (Commitment of Traders) report for May 23rd, there was a reduction in both long and short positions. Last week, the decline of the British pound continued, but judging by the reduction in positions of both sides, the change in the balance of power was minimal. The fear of a US debt limit agreement and the onset of a recession forced traders to close positions, especially in the face of further uncertainty regarding the Bank of England's monetary policy. According to statements from the regulator, there may be a pause in the cycle of interest rate hikes, but inflationary pressure in the UK does not currently allow for it. The latest COT report mentioned that non-commercial short positions decreased by 7,181 to 57,614, while non-commercial long positions fell by 8,185 to the level of 69,203. This led to a decrease in the non-commercial net position to 11,059 compared to 12,593 the previous week. The weekly price decreased and reached 1.2425 compared to 1.2495.

Indicator signals:

Moving Averages

Trading is conducted above the 30-day and 50-day moving averages, indicating further pound growth.

Note: The author considers the period and prices of moving averages on the H1 hourly chart, which differs from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator, around 1.2506, will act as support.

Description of indicators:

• Moving average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

• Moving average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

• MACD (Moving Average Convergence/Divergence) indicator: Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands: Period 20.

• Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

• Non-commercial long positions: Represents non-commercial traders' total long open positions.

• Non-commercial short positions: Represents non-commercial traders' total short open positions.

• Non-commercial net position: The difference between non-commercial short and long positions.