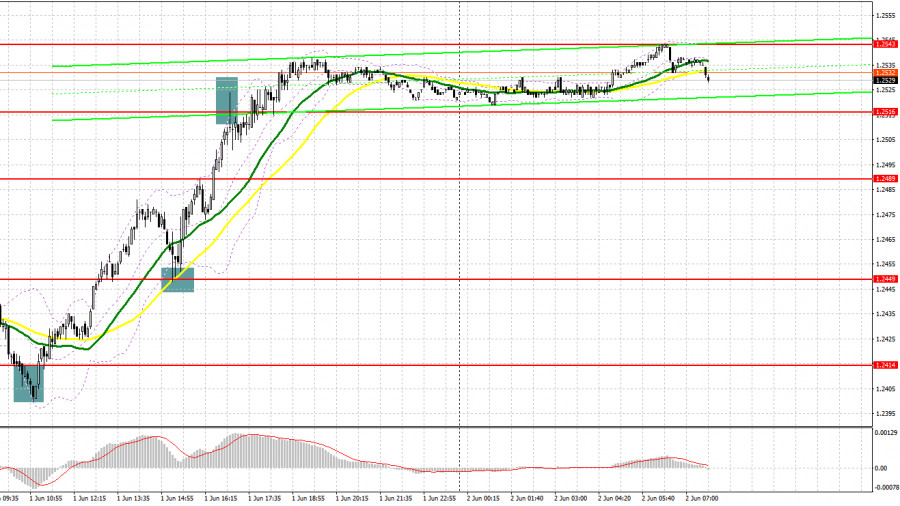

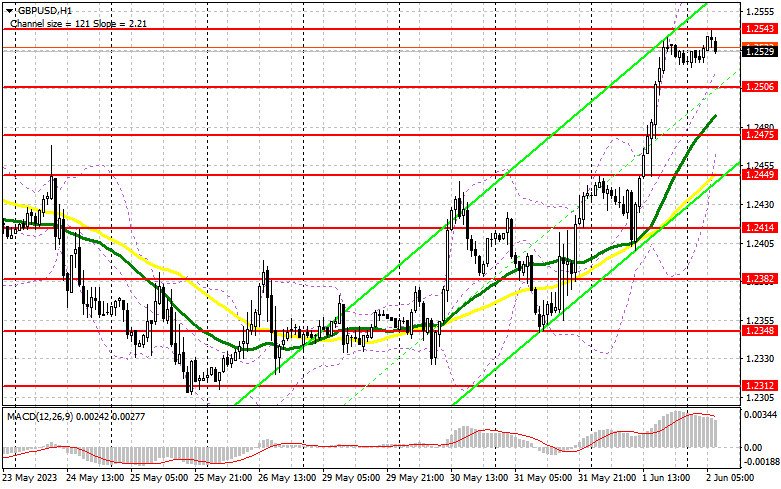

Yesterday, several entry signals were made. Let's look at the 5-minute chart to get a picture of what happened. I considered entering the market from the level of 1.2414. A fall and a false breakout generated a buy signal. The price rose by more than 50 pips. In the American session, the pair dropped after the publication of US labor market data, but the bulls still protected 1.2449. After another buy signal, the pair advanced by 65 pips. Short positions at 1.251 brought no desired result.

When to open long positions on GBP/USD

In the UK, the manufacturing PMI kept contracting in May although at a slower pace than in April. The pair barely reacted to those results. At the same time, the ISM manufacturing PMI in the US triggered a mass sell-off of the greenback and boosted the pound. Today, GBP/USD will still be in demand. In the American session, data on the US labor market will be in focus. Therefore, buying at current highs will hardly be a good idea. Rather, positions should be opened when a bearish correction occurs.

If the bulls protect 1.2475 support and a false breakout follows, a buy signal will be generated with the target at 1.2543 resistance. An additional buy signal targeting 1.2576 will come after a breakout and consolidation above the mark on disappointing macro data in the US. The most distant target stands at 1.2607 where I will lock in profit. If the price goes toward 1.2506 and there is no bullish activity there, pressure on the pound will increase, and the bears will get a chance to stop yesterday's growth. In such a case, a sell signal will come after protecting 1.2475 and a false breakout. I will buy GBP/USD on a bounce from 1.2449, allowing a correction of 30-35 pips intraday.

When to open short positions on GBP/USD:

After triggering a row of bearish Stop Losses yesterday, the bulls will likely build a new uptrend today. That is why bearish activity may only increase near 1.2543 resistance and after a false consolidation above this range. This will generate a sell signal and trigger a small correction to 1.2506 support. A breakout and an upside retest of this range will occur only if US macro data comes upbeat. GBP/USD will face pressure, producing a sell signal targeting 1.2475. The most distant target is still seen at a low of 1.2449 where I will lock in profits.

If GBP/USD goes up and there is no activity at 1.2543, the bull market will continue. I will open short positions after a test of 1.2576 resistance. A false breakout will create a sell entry point. If there is no bearish activity there either, I will sell GBP/USD on a bounce from a high of 1.2607, allowing a bearish correction of 30-35 pips intraday.

Commitments of Traders:

The COT report for May 23 shows a decrease in both long and short positions. Last week, the pound was bearish. However, with a drop in both longs and shorts, a shift in trading powers seems minimal. Traders had to close positions fearing the US debt ceiling deal would not be reached. Moreover, recession risks were still weighing on them. They were also concerned about the Bank of England's monetary policy stance. The regulator said it might pause tightening although inflationary pressures in the UK were still high. According to the latest COT report, short non-commercial positions dropped by 7,181 to 57,614, and long non-commercial positions decreased by 8,185 to 69,203. The non-commercial net position fell to 11,059 from 12,593 a week earlier. The weekly price dropped to 1.2425 from 1.2495.

Indicators' signals:

Moving averages:

Trading is carried out above the 30-day and 50-day moving averages, which indicates a bullish continuation.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Support stands at 1.2475, in line with the lower band.

Indicators:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.